Let's go to the basics.

Throughout our life, we have to make many financial decisions, such as:

I want to buy an Ipod...

I want to buy a notebook...

I want to get married...

I want to buy a family car...

I want to take my family on a holiday every year...

I hope to upgrade to a bigger flat or apartment in 5 years...

I wish to provide my kids with an overseas university education...

However, we often make our financial decisions in a haphazard manner. We tend to have no overall direction or lose the determination to enforce our decisions. Eventually, we do not achieve our intended goals or take a longer time to achieve them. And because we are so caught up with our immediate financial concerns during the most productive period of our lives, we fail to accumulate a sizeable nest egg for a comfortable lifestyle when we retire.

This is where financial planning plays a crucial role to help you achieve your goals and long-term financial well-being.

What is Financial Planning?

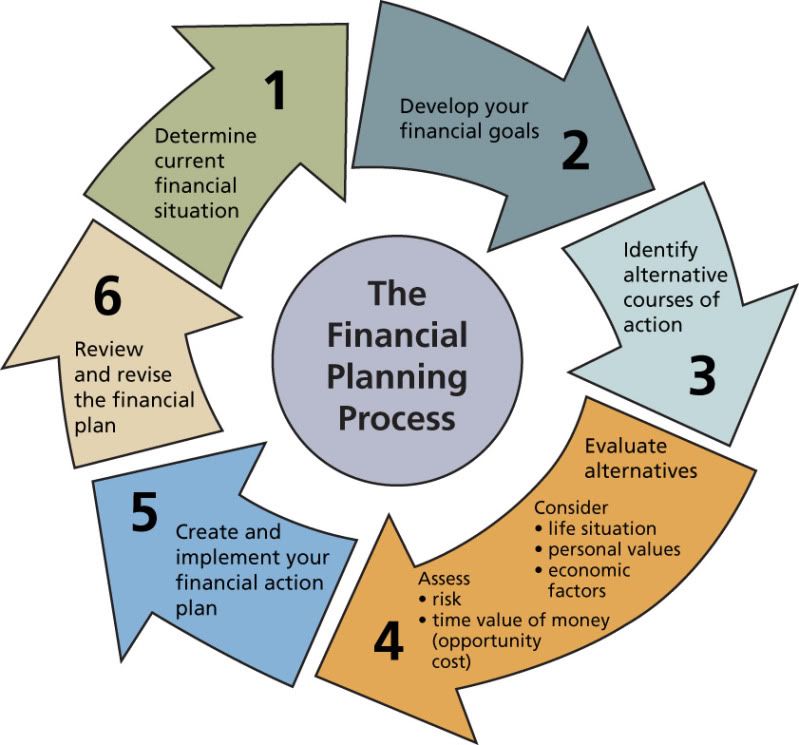

Financial planning is the process of meeting your life goals through the proper management of your finances. It is a process that consists of specific steps that help you ascertain your financial condition objectively. The process involves gathering relevant financial information, setting life goals, examining your current financial status and coming up with a strategy or plan on how you can meet your current situation and future plans.

Take Charge & Plan Early!

With financial planning, achieving your short-term and long-term financial goals will become possible. Of course, the success of your financial plan depends on how realistic your goals are, how early you start, how much time you have to achieve those goals and how conscientious you are in following the plan.

Retirement planning seldom ranks as one of our top prorities as other issues, such as buying a dream house or paying off a car loan, seem more pressing. Most of us only start planning for retirement in our 40's. However, many of us do not realise that the longer we put off planning, the greater the savings we need to set aside for our retirement. More updates on this next Wednesday.

No comments:

Post a Comment